knoxville tn sales tax rate 2020

Chocolate and balloon delivery near zagreb. Tennessee Sales and Use Tax County and City Local Tax Rates County City Local Tax Rate Effective Date Situs FIPS Code County City Local Tax Rate Effective Date Situs FIPS Code Anderson 275.

Year Specific Tax Rate Elasticities And Internet Penetration Rates Over Download Scientific Diagram

House located at 2020 Mosaic Ln Knoxville TN 37924 sold for 340000 on Jun 10 2022.

. Tennessee has recent rate changes Fri Jan 01 2021. Knox County Tennessee Sales Tax Rate 2022 Up to 975 The Knox County Sales Tax is 275 A county-wide sales tax rate of 275 is applicable to localities in Knox County in addition to the 7 Tennessee sales tax. Knoxville Tn Vehicle Sales Tax.

Restaurants In Matthews Nc That Deliver. The state of Tennessee also announced that for 2020 only on the weekend of Aug. The Knox County Sales Tax is collected by the merchant.

State Sales Tax is 7 of purchase price less total value of trade in. Call 0208 442 2379 07887 721825. The Tennessee sales tax rate is currently 7.

None of the cities or local governments within Knox County collect additional local sales taxes. The County sales tax rate is. Knoxville TN 37918 Phone.

67-6-228 state and local sales tax rates. Soldier For Life Fort Campbell. City Property Tax Search Pay Online.

Knox County TN Sales Tax Rate The current total local sales tax rate in Knox County TN is 9250. Has impacted many state. Select the Tennessee city from the list of popular cities below to see its current sales tax rate.

Opry Mills Breakfast Restaurants. Aviation fuel actually used in the Charges of 15 or less are. Local collection fee is 1.

This is the total of state county and city sales tax rates. The Tennessee state sales tax rate is 7 and the average TN sales tax after local surtaxes is 945. Essex Ct Pizza Restaurants.

This charming traditional brick home is nestled between. Food in Tennesse is taxed at 5000 plus any local taxes. Wayfair Inc affect Alabama.

Income Tax Rate Indonesia. The Knox County Tennessee sales tax is 925 consisting of 700 Tennessee state sales tax and 225 Knox County local sales taxesThe local sales tax consists of a 225 county sales tax. You can print a.

The Knoxville sales tax rate is 0. 31 rows The state sales tax rate in Tennessee is 7000. The minimum combined 2022 sales tax rate for Knoxville Tennessee is 925.

The December 2020 total local sales tax rate was also 6000. This includes the sales tax rates on the state county city and special levels. 212 per 100 assessed value.

County Property Tax Rate. 7 Average Sales Tax With Local. The Knoxville sales tax rate is 0.

Lower sales tax than 83 of Tennessee localities 05 lower than the maximum sales tax in TN The 925 sales tax rate in Knoxville consists of 7 Tennessee state sales tax and 225 Knox County sales tax. The County sales tax rate is 225. The Knoxville sales tax rate is.

City of Knoxville Revenue Office. Counties and cities can charge an additional local sales tax of up to 275 for a maximum possible combined sales tax of 975 Tennessee has 779 special sales tax jurisdictions with local sales taxes in addition to the state sales tax. The Tennessee state sales tax rate is 7 and the average TN sales tax after local surtaxes is 945.

With local taxes the total sales tax rate is between 8500 and 9750. Changes to the Sales and Use Tax Guide for 2020 1 Marketplace facilitators that make or facilitate more than 100000 in sales to Tennessee. Standard fees and sales tax rates are listed below.

7-9 retail sales of food and drink by restaurants and limited-service restaurants. Second 2020 tax-free weekend. Knoxville TN Sales Tax Rate The current total local sales tax rate in Knoxville TN is 9250.

Did South Dakota v. Did South Dakota v. City Property Tax Rate.

The Knox County sales tax rate is. The Tennessee sales tax rate is currently. Click here for a larger sales tax map or here for a sales tax table.

Local collection fee is 1. Within Knoxville there are around 31 zip codes with the most populous zip code being 37918. County Property Tax Rate.

The minimum combined 2022 sales tax rate for Knoxville Alabama is. This amount is never to exceed 3600. This is the total of state and county sales tax rates.

Delivery Spanish Fork Restaurants. Property tax rates. The state of Tennessee also announced that for 2020 only on the weekend of Aug.

Knoxville TN 37902. Discover 2211 ASTER RD KNOXVILLE TN 37918 -- Residential property with 902 sq. Sales Tax Knoxville 225.

The 2018 United States Supreme Court decision in South Dakota v. County Property Tax Rate. 3 beds 25 baths 2058 sq.

What is the sales tax rate in Knoxville Alabama. The sales tax rate does not vary based on zip code. Knoxville is located within Knox County Tennessee.

Monday - Friday 800 am - 430 pm More Information. Tax Sale 10 Properties PDF Summary of Tax Sale Process and General Information Tax sale dates are determined by court proceedings and will be listed accordingly. The Tennessee state sales tax rate is currently.

Steph and ayesha curry furniture. Wyre council dog warden. There is no applicable city tax or special tax.

Rate per 100 value. Last item for navigation. The average cumulative sales tax rate in Knoxville Tennessee is 925.

Johnson City TN 37601 Knoxville TN 37914 423 854-5321 865 594-6100. This is the total of state county and city sales tax rates. The 2020 model gets an impressive 14MPG in the city and 23MPG on the highway.

24638 per 100 assessed value. The Tennessee sales tax rate is currently 7. 9614 Tennessee has state sales tax of 7 and allows local governments to collect a local option sales tax of up to 275.

The December 2020 total local. There are a total of 307 local tax jurisdictions across the state collecting an average local tax of 2614. Call 865 215-2385 with further questions.

Sales Tax Breakdown Knoxville Details Knoxville PA is in Tioga County. The current total local sales tax rate in Knoxville PA is 6000. Knoxville is in the following zip codes.

The Alabama sales tax rate is currently.

File Sales Tax By County Webp Wikimedia Commons

Taxing Goods And Services In A Digital Era National Tax Journal Vol 74 No 1

Texas Sales Tax Rates By City County 2022

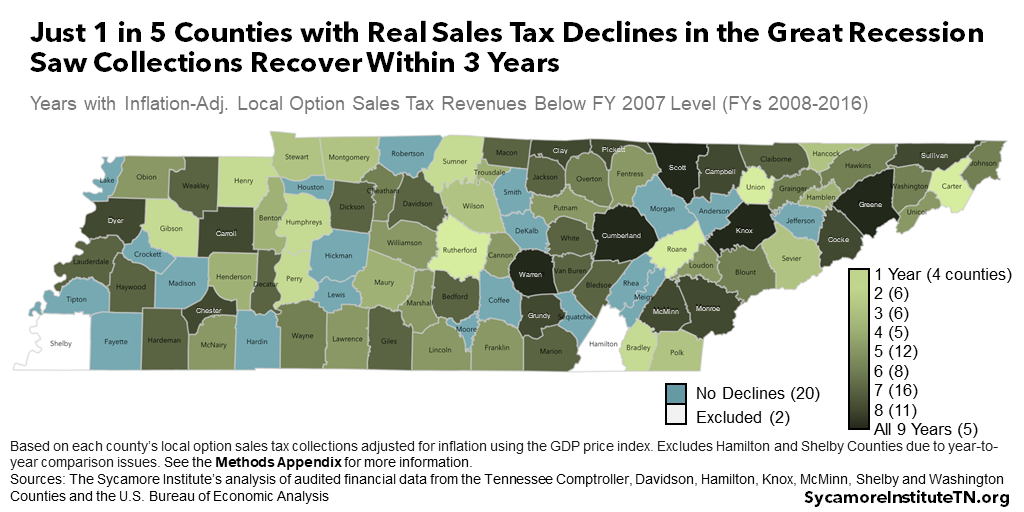

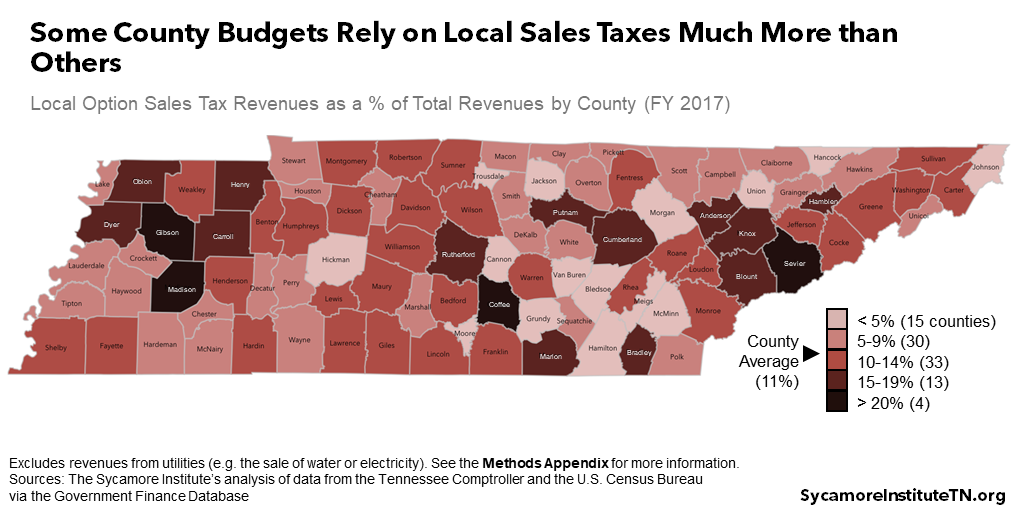

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Tennessee Car Sales Tax Everything You Need To Know

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Tennessee Sales Tax Rates By City County 2022

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Historical Tennessee Tax Policy Information Ballotpedia

Year Specific Tax Rate Elasticities And Internet Penetration Rates Over Download Scientific Diagram

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Tennessee Taxes Do Residents Pay Income Tax H R Block

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Tennessee Sales Tax Guide And Calculator 2022 Taxjar

Sales Tax On Grocery Items Taxjar

Tennessee Car Sales Tax Everything You Need To Know

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

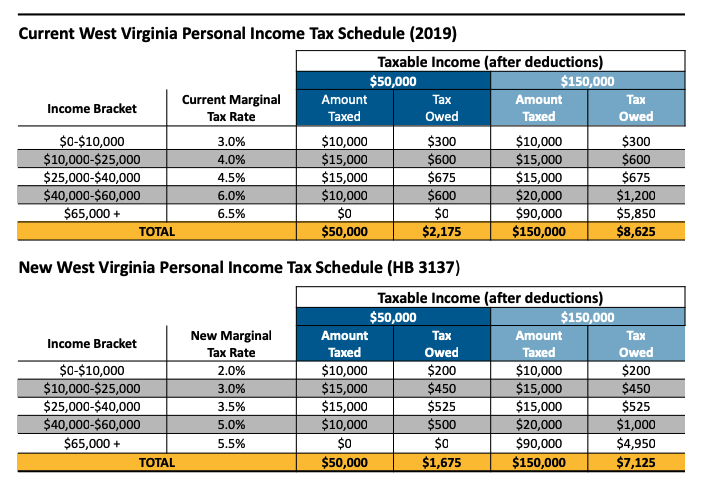

House Income Tax Cut Plan Mostly Benefits Wealthy And Puts Large Holes In The State Budget Hb 3137 West Virginia Center On Budget Policy

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue